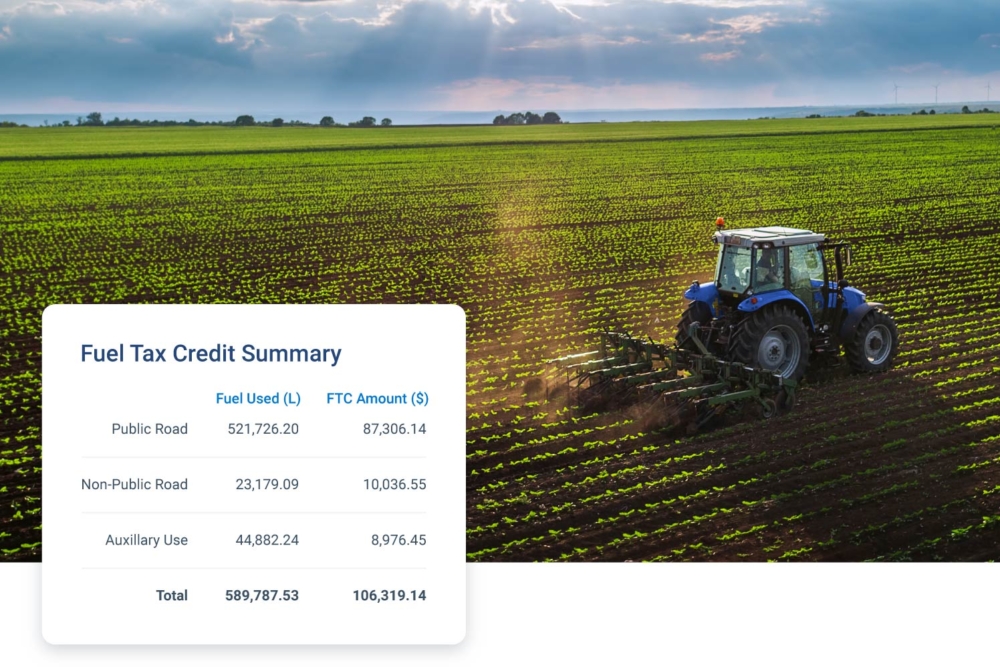

Fuel Tax Credits Reporting Software

Calculate Fuel Tax Credits with Speed and Efficiency. Powerfleet partners with Australia’s leading FTC automation providers to help you maximise your credits.

Trusted by Fleets Across All Industries

Automate Fuel Tax Credit Calculations for Connected Fleets with Powerfleet

Frequently Asked Questions

Fuel tax credits (FTCs) are rebates provided by the government for the fuel tax (excise) included in the price of fuel used in business operations. These credits help reduce the overall cost of fuel, improving cash flow and lowering operating expenses for businesses.

Fuel tax credits are crucial as they:

- Reduce fuel costs for businesses.

- Improve cash flow and operational efficiency.

- Offset the expense of fuel used for various business activities, both on-road and off-road.

Fuel tax credits are available to a wide range of industries, including:

- Transportation and logistics

- Agriculture and Farming

- Construction and Mining

- Manufacturing

Maximising fuel tax credits involves several key strategies to ensure accurate claims and optimise fuel usage. Keeping detailed records is essential, as precise and comprehensive documentation of all fuel purchases, usage, and business activities supports your claims. Implementing efficient routing and scheduling techniques can minimise fuel consumption and enhance operational efficiency. Utilising specialised software and telematics systems allows for accurate tracking and reporting of fuel usage, ensuring precise apportionment and compliance. Regularly reviewing and updating processes to align with the latest regulations and industry best practices is crucial. Additionally, training staff on the importance of accurate record-keeping and efficient fuel usage can further maximise eligible credits.

The easiest way to calculate your fuel tax credits is to invest in fuel tax credit calculator software, such as Powerfleet’s. This software automates the process, ensuring accuracy and saving you time. While it is possible to calculate fuel tax credits manually, doing so increases the potential for errors and is significantly more time-consuming.

Eligible fuels include diesel, petrol, blended fuels, and certain alternative fuels used in specified activities. Understanding which fuels qualify for credits and the specific circumstances under which they are eligible is crucial for maximising your claims.

Fleet management software, like Powerfleet’s, simplifies this process by automating fuel tracking and monitoring real-time fuel consumption. This software provides accurate data for calculating fuel tax credits, ensuring compliance, and optimising your fuel usage. By leveraging advanced tracking and reporting features, Powerfleet’s software helps you easily identify and document eligible fuel types and activities, streamlining the process and maximising your fuel tax credits.